Course notes in Core Economics

Over 1981-88, I was an Assistant Professor of Economics, American University, Washington, DC. I taught mainly graduate courses. My fields were Econometrics and Development Economics.

In 2007, I returned to this University on a part-time basis. One the courses I taught was Introductory Economics for graduate students in the School of International Service. For most of them, this was a required course because they had not taken any economics course as undergraduates (or had completely forgotten what they had studied then.) And, most of them did not take any other course in economics.

I had asked to teach this course. Over the years, I had come to feel that introductory economics textbooks were not suitable for students who did not want to be economists. Therefore, I had said that I would write my own lectures from scratch, and not use any textbook.

This is what I actually did.

I am no longer teaching this course. I have now decided to convert my written chapters into small sections. Each section is a separate pdf file. Each section should take about 10 minutes to read. I am updating the material as I go along.

I have not decided how many sections I will create. It depends upon the demand (after all, I am an economist).

The first file is here Core Economics – Section 1.00: Introduction.

Core Economics – Cluster 1

This cluster has Sections 1.01 – 1.07.

The complete file is here Core Economics – Cluster 1.

Core Economics – Section 1.01: What is economics about? Scope and objectives of economics

In brief, economics tries to:

1. explain how the economic world works

2. forecast what will happen to the economy, and

3. suggest policies that will help the economy to function better.

Download the file here Core Economics – Section 1.01.

Core Economics – Section 1.02: Expansion of the scope of economics

Economists have been extending the scope of economics into areas previously thought outside its domain. We discuss two such extensions here: family economics and the economics of terrorism.

Download the file here Core Economics – Section 1.02.

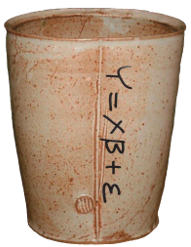

Core Economics – Section 1.03: Economic models

In considering any economic issue, academic economists first create a theoretical model of the behavior of economic agents involved in the issue. The behavior of the agents can be described in words or in mathematical terms. This is the place where mathematics enters economic analysis.

Download the file here Core Economics – Section 1.03.

Core Economics – Section 1.04: Economics in Action: Impact of foreign aid following 2004 Sri Lanka tsunami

A tsunami struck Sri Lanka and several other countries on December 26, 2004. About 36,000 persons died in Sri Lanka. Another half a million people (total Sri Lanka population: 19 million) were displaced. Thousands of homes were damaged or completely wiped out. Incomes were lost because many people in the affected areas lost their livelihood.

Foreign aid poured in to help Sri Lanka. This analysis of the aid received by Sri Lanka after it was hit by a tsunami brings out two results:

1. Foreign aid can have adverse impacts on export-oriented sectors of the economy and increase the price level. Here the impact of the aid is similar to the discovery of a natural resource, such as oil, that brings with a sudden influx of foreign exchange earnings.

2. Foreign aid can also provide benefits to people who are not the target beneficiaries.

Download the file here Core Economics – Section 1.04.

Core Economics – Section 1.05: Economics in Action: Who gets to set the retail price?

In the US, the Sherman Act of 1890 had been interpreted by the courts to mean that it was illegal to set price floors per se. “Per se” means it was a blanket ban. No manufacturer could force a retailer to charge a particular price. The producer could only suggest a price. Hence, the term MSRP – manufacturer’s suggested retail price. The retailer could sell it for any price – including giving it away free.

Download the file here Core Economics – Section 1.05.

Core Economics – Section 1.06: Economics in Action: Comparing the future to today

In many situations in the real world, it is necessary to consider money flows that occur in several periods of time.

A firm may undertake a substantial investment, such as building a new factory, in the expectation of high returns from future profits. These profits may come for the next 15-20 years. How do you compare the stream of future profits to the costs that have been incurred today? In the business world, companies typically undertake what is called as Discount Cash Flow (DCF) analysis.

Download the file here Core Economics – Section 1.06.

Core Economics – Section 1.07: Economics in Action: Examples of the use of discount rates

In this section, we look at three case studies:

1. Costs and benefits of the Clean Air Act

2. Clean the Ganges in India

3. Fighting climate change

Download the file here Core Economics – Section 1.07.